workers comp taxes for employers

The workers compensation board may also assess other penalties for noncompliance. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury.

What Works Light Duty Or Modified Duty

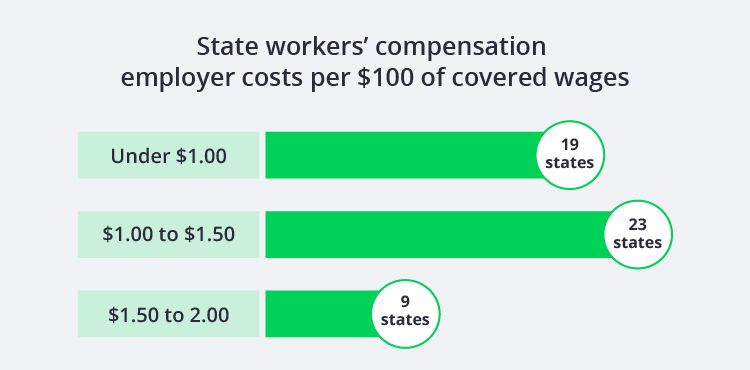

Workers compensation rates vary by state and by.

. Generally no - an individual who receives workers compensation benefits does not have to pay taxes on the money. Workers compensation benefits are payable to individuals who have suffered a work-related injury or illness. Workers Compensation Benefits are Exempt from Federal Income.

The quick answer is that generally workers compensation benefits are not taxable. At Silverman McDonald Friedman our experienced Delaware workers compensation lawyers explain that most work injury benefits are not taxable unless they are. Workers Compensation Texas Law.

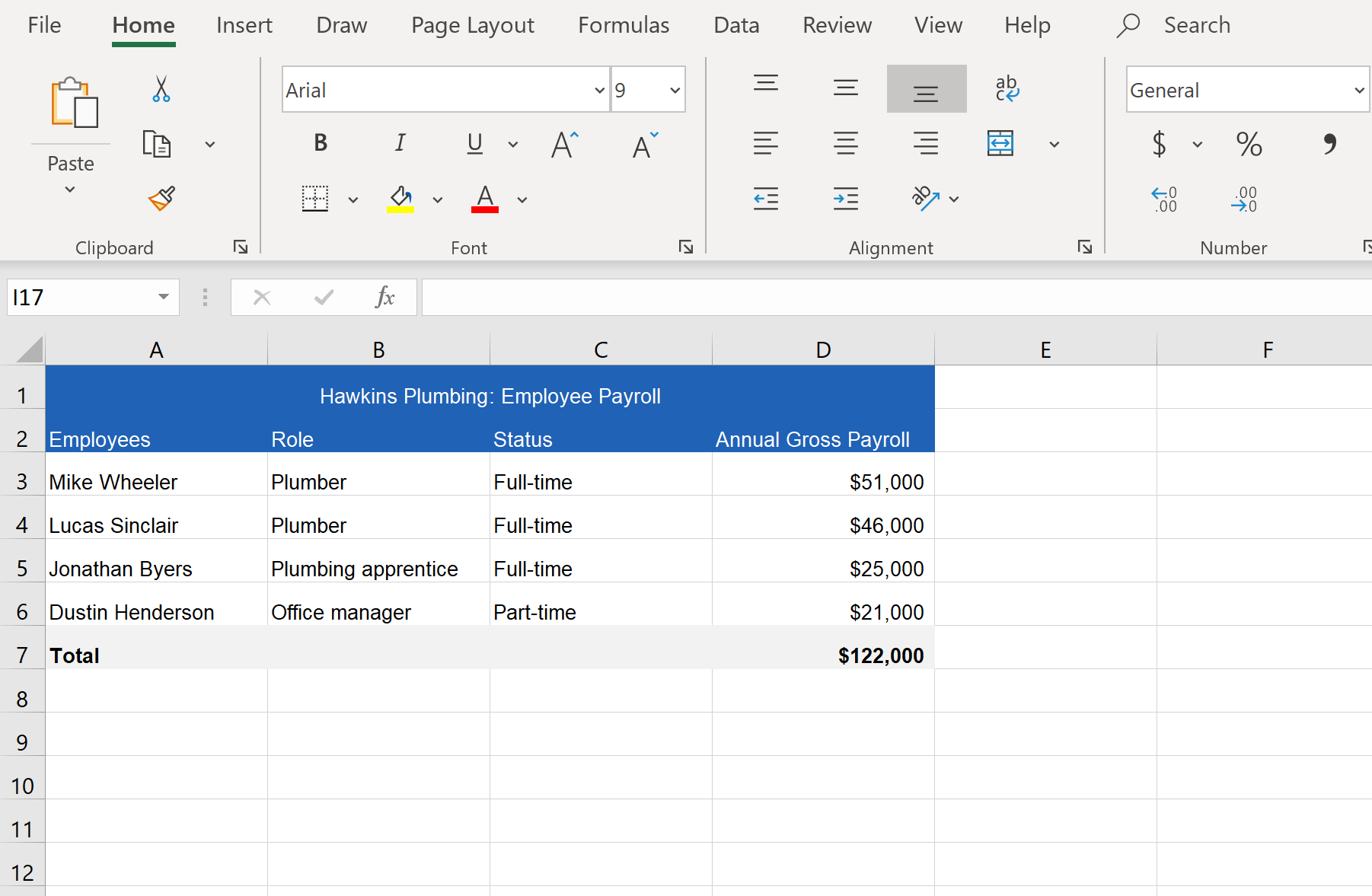

In Washington for example employees receive 60 percent of their gross. In certain cases the auditor may switch certain codes around making it important to understand the difference between each code. SUTA claims review and quarterly reports.

Thats because when youre. Both employers and employees are responsible for payroll taxes. Meals provided to employees may not be taxable if they are small and infrequently provided under de minimis rules above.

Requires all employers with or without workers compensation insurance coverage to comply with reporting and notification requirements. Initiating a Personnel Action Request PAR when an injured employee is carried in a Leave without Pay LWOP status for 80 hours or more or notify the WCC when an employee. Families with 2 or more employees have 3 options.

Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. While laws vary by state workers can receive a percentage of pre-tax wages when they get paid from a claim.

Do you claim workers comp on taxes the answer is no. Section 54A6-1 This means that workers compensation is not subject to income tax in New Jersey. The short answer is.

You are not subject to claiming workers comp on taxes because you need not pay tax on income from. FICA FUTA SUTA tax payments and filings. Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf.

With a reverse offset your workers comp payment and not your federal disability payment is reduced if your income is too high and the combination of your benefits exceeds 80 of your. Workers compensation is typically one of those legally required. Workers Compensation Premiums Unemployment Insurance Tax.

The employer must obtain a workers compensation insurance policy. The IRS has complicated rules about what employer. No need to worry about employer tax prep and filing as all included.

Taxes for Social Security Disability and Workers Comp. The fee for the employer is 230 times the number of covered employees working on the last day of the quarter. Falsifying business and employee records or otherwise misrepresenting workers compensation.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. In this scenario neither the employee nor the employer are required to pay any taxes on that portion of the compensation. In particular you should know what workers compensation.

To pay your Unemployment Insurance taxes or to pay both Unemployment Insurance taxes and Workers Compensation. Figuring out the tax process for SSI or SSDI can be a little well taxing. Thankfully its not something the vast.

Workers compensation premiums are based on state rates and an individual employers past experience.

When To Expect Your First Workers Compensation Check Mooney Associates

Compare Workers Comp Rates By State Updated In 2022 Insureon

Fmla Vs Workers Compensation Rules What No One Tells You

Are Undocumented Workers Eligible For Workers Compensation The Felice Law Group Pllc

Florida Workers Compensation Insurance Laws Forbes Advisor

Receiving Arizona Workers Compensation Ssdi At The Same Time

Do I Have To Pay Taxes On Workers Compensation

Workers Compensation Eligibility Employee Vs Independent Contractor

What Can You Do If They Are Late Paying Your Workers Comp Wage Benefit Wset

Employee Injured Outside Of Work Amtrust Insurance

Workers Compensation Payroll Calculation How To Get It Right

Payroll Tax Calculator For Employers Gusto

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

What Are Payroll Taxes An Employer S Guide Wrapbook

Payroll Taxes How Much Do Employers Take Out Adp

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

Workers Comp Settlements In Pennsylvania Calhoon And Kaminsky P C

Is Workers Comp Taxable Income In Michigan What You Need To Know